UPI achieves 15,547 crore transactions worth Rs 223 lakh crore from January to November

India’s Unified Payments Interface (UPI) has achieved a major milestone in 2024, processing an astounding 15,547 crore transactions

which collectively amount to Rs 223 lakh crore, from January to November.

This announcement from the Finance Ministry highlights the transformative effect that UPI has had on the financial landscape in India.

The milestone emphasizes UPI’s importance not just as a tool for everyday payments but as a central pillar in India’s digital payments revolution.

The rise of UPI showcases its powerful impact on modernizing the financial system and its role in shaping the future of digital payments.

Countries Accepting UPI

What is UPI?

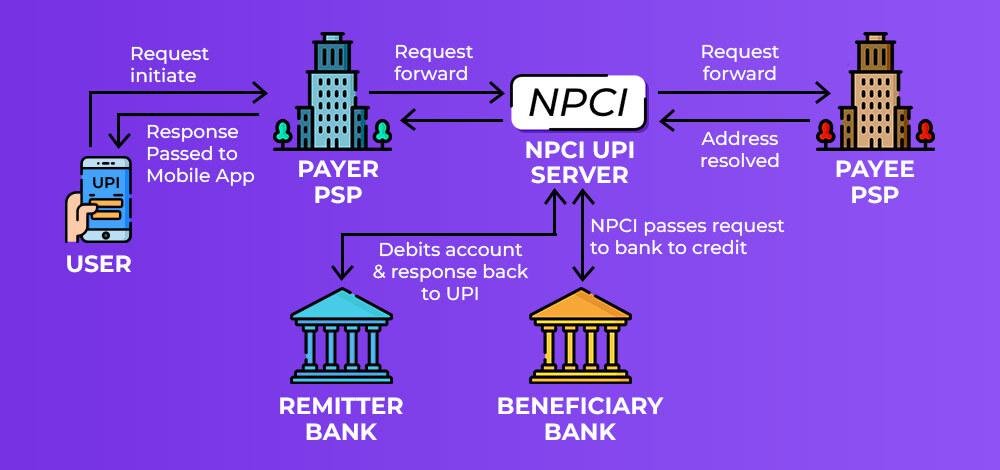

Launched in 2016 by the National Payments Corporation of India (NPCI), UPI is a digital payment system that enables instant money transfers between bank accounts. With UPI, users can send and receive money, pay bills, buy goods, and transfer funds seamlessly using their smartphones.

Unlike traditional payment systems, UPI is a unique, real-time solution that integrates multiple bank accounts into a single mobile application.

It allows users to manage all their financial activities, including peer-to-peer transfers, merchant payments, and bill payments, all within one interface.

One of the key features of UPI is its ease of use. The platform is designed to simplify payments by allowing users to make transactions 24/7, without the need for any complex procedures.

Users can even schedule payments for later, giving them the flexibility to manage their finances according to their needs.

It’s also a highly secure platform, thanks to features like two-factor authentication, which protects users’ sensitive information during transactions.

The Impact of UPI in India

The rapid adoption of UPI has revolutionized India’s payment system, making digital transactions accessible to millions of people. It has eliminated the need for physical cash and checks, reducing the reliance on traditional banking methods.

Whether it’s paying for groceries, splitting a restaurant bill with friends, or making larger payments for services, UPI has made it easier and faster.

As of 2024, UPI’s user base continues to grow at a tremendous pace. This growth has been driven by the increasing use of smartphones and internet access across the country, which has empowered people from all walks of life to make secure digital payments.

Small businesses, too, have benefited from UPI’s ease of use. By accepting UPI payments, vendors, shopkeepers, and even street vendors can reduce their dependence on cash transactions and expand their customer base.

The transaction figures released by the Finance Ministry—15,547 crore transactions worth Rs 223 lakh crore—are a testament to UPI’s widespread adoption and success.

UPI’s contribution to India’s digital economy has been significant, and it continues to drive financial inclusion by making banking services available to remote and underserved areas.

Global Expansion of UPI

UPI’s success isn’t confined to India alone. The platform has expanded beyond borders, gaining recognition in several countries.

Currently, UPI is operational in seven countries: the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius.

This expansion highlights the growing international demand for a fast, secure, and efficient payment system like UPI.

In countries like the UAE and Singapore, UPI is being used to facilitate cross-border transactions, making it easier for people from India to send money to their families and businesses in these regions.

The ease of use and cost-effective nature of UPI has made it an attractive option for individuals and businesses alike.

Additionally, UPI’s collaboration with global payment networks and financial institutions has paved the way for further international expansion.

This has positioned India as a leader in the global digital payments landscape, with UPI at the forefront of this transformation.

The Future of UPI

The future of UPI looks incredibly promising. With the continued growth of internet penetration and smartphone adoption in India, UPI is set to reach even more users.

The government’s focus on financial inclusion and the promotion of digital payments will ensure that UPI remains a key driver of India’s economic growth.

In the coming years, UPI is likely to become even more integrated into everyday life, not just in India but globally. New innovations, such as UPI-based services for online shopping, government services, and even international money transfers, are expected to make the platform even more versatile and user-friendly.

UPI has undoubtedly changed the way people make payments in India.

With over 15,547 crore transactions processed this year alone, it is clear that UPI has become a cornerstone of India’s digital economy.

Its simplicity, security, and efficiency have made it a preferred choice for millions of Indians and are now being embraced by countries around the world.